“This is a classic Titanic situation in the sense that what we saw with the Fannie and Freddie bailouts and the Bear Stearns bailouts and now the AIG request for more than forty billion more dollars from the federal government – it’s just like the Titanic where the rich and affluent were given the lifeboats and the rest of the people went under from steerage. The rich and powerful are too big to fail; the rest of us are too small to save.”

- Gerald Celente, Editor and Publisher, The Trends Journal

“They (Republican Party) had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.”

- Franklin Delano Roosevelt, 1936, quoted in The FDR Years © 1995 by William Leuchtenburg

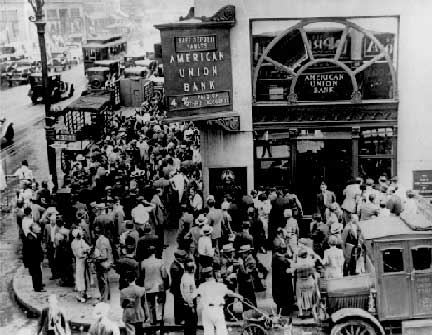

Updated 11:00 PM EDT September 17, 2008 - Dow closed 450 down today in continuing “Economic 9/11,” after Feds loan AIG $85 billion and oil and metals spiked upward. “Right now, citizens don't trust banks and bankers don't trust other bankers. The financial system is freezing up,” said a CNBC Business Network analyst.

Investors also considered a report on new home construction that showed that housing starts dipped to a 17-year low. Further, the FDIC website lists 11 bank failures in 2008 since April, the latest being Silver State Bank in Henderson, Nevada, on September 5, 2008. The Pasadena, California, IndyMac Bank FDIC takeover on July 11, 2008, was the second largest bank failure in American history.

Click here to subscribe and get instant access to read this report.

Click here to check your existing subscription status.

Existing members, login below:

© 1998 - 2025 by Linda Moulton Howe.

All Rights Reserved.